On the date of publication, Cristian Docan did not have (either directly or indirectly) any positions in the securities mentioned in this article. Read More: Penny Stocks - How to Profit Without Getting Scammed If we ever do publish commentary on a low-volume stock that may be affected by our commentary, we demand that ’s writers disclose this fact and warn readers of the risks. That’s because these “penny stocks” are frequently the playground for scam artists and market manipulators. On Penny Stocks and Low-Volume Stocks: With only the rarest exceptions, InvestorPlace does not publish commentary about companies that have a market cap of less than $100 million or trade less than 100,000 shares each day.

Investors looking to enter this carbon capture play should not underestimate the high risks of buying penny stocks. With all that, there is no surprise that the stock has dipped to new all-time lows. 30, 2021, DCTIF reported total revenues of $300,000, an operating loss of $1.13 million and a yearly net loss of $1.79 million. However, the fundamental picture of Delta Cleantech is in poor condition. The company recently announced that it plans to “… begin the expansion and accelerated growth of Delta’s wholly owned subsidiary, Carbon RX, a carbon credit origination, aggregation, tokenization, and streaming business originally found in 2006 as North American pioneer in the voluntary carbon credit market.

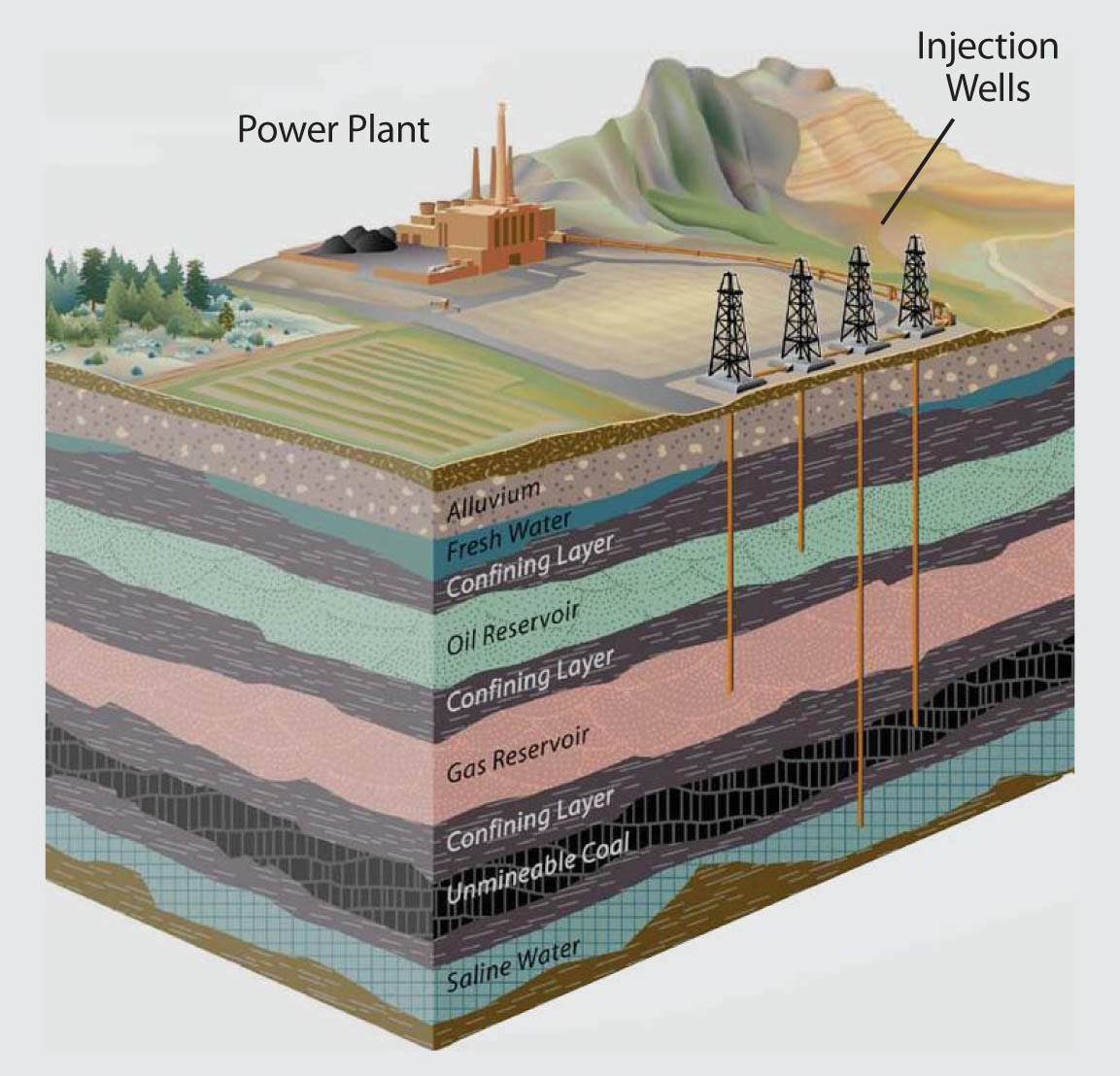

Since the beginning of the year, DCTIF shares plunged 65% to 11 cents per share, underperforming significantly the carbon market and posting a ridiculously low market capitalization of $6 million. Its main operations consist of “carbon dioxide (CO2) capture, decarbonization of energy, solvent & glycol reclamation, blue hydrogen production, and carbon credit aggregation and management.” The company services the CO2 capture market through its Delta Reclaimer purification technology.

+CCRES.jpg)

DCTIF is a clean energy company based in Canada.

0 kommentar(er)

0 kommentar(er)